Plan Ahead for Hurricane Season in Virginia and the Carolinas

Home Insurance

Each year, hurricane season – June 1 to November 30 – presents a significant risk to homeowners. Not limited to coastal areas, hurricanes can cause major property damage due to storm surge, wind damage, and flooding.

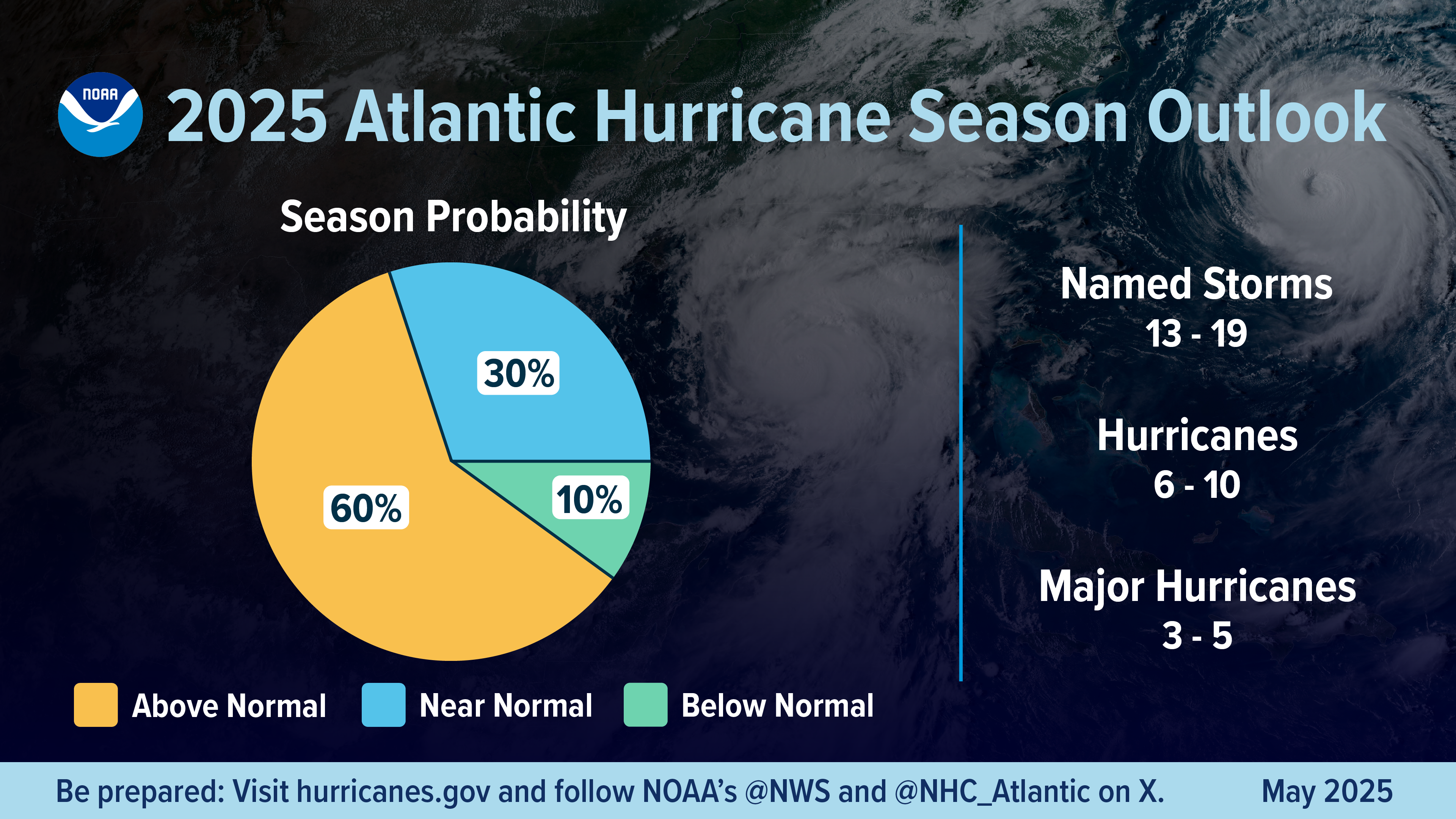

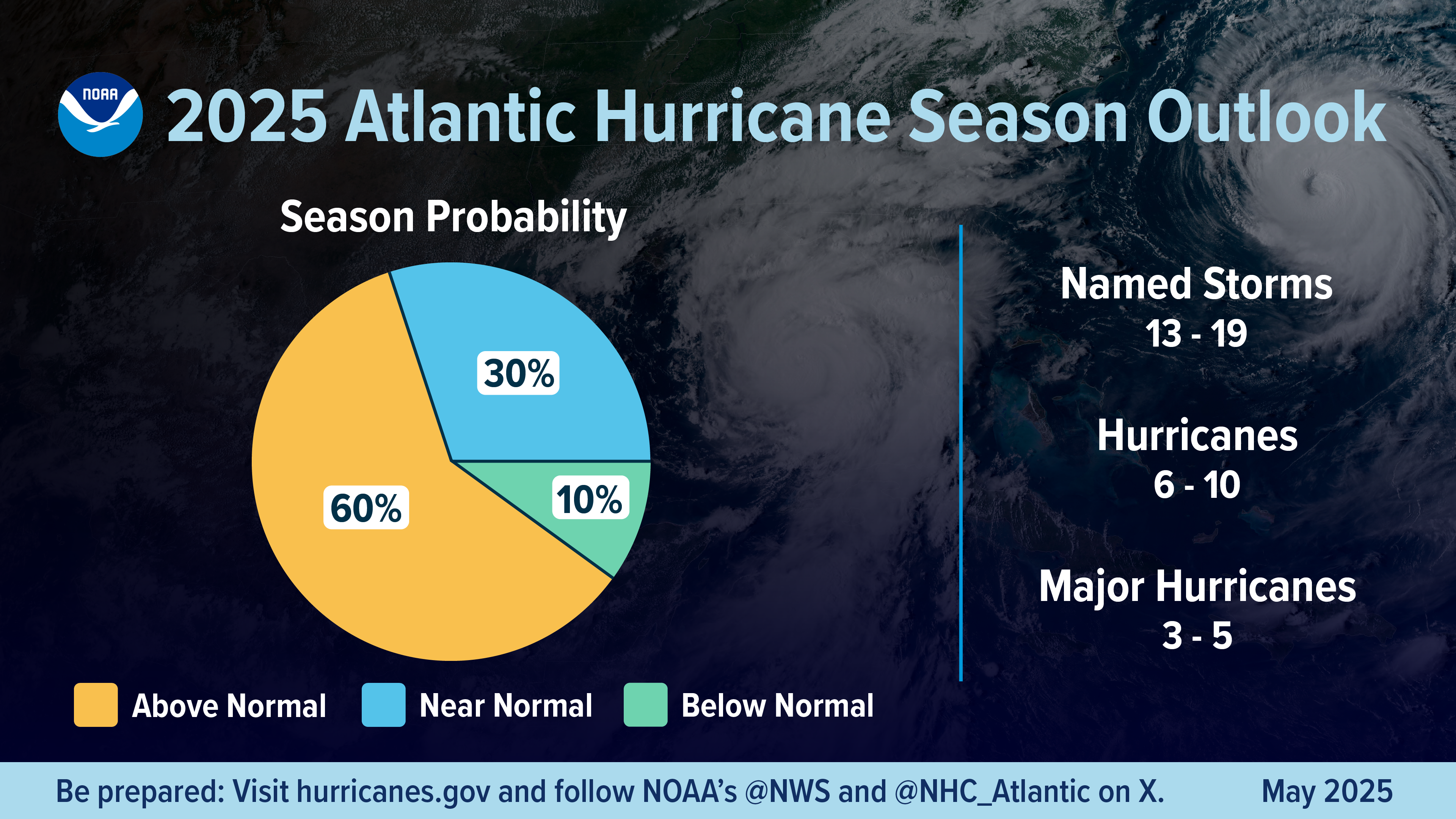

NOAA has predicted a 60% chance of an above-normal Atlantic Hurricane season, due to a confluence of factors including warmer than average ocean temperatures and forecasted weak wind shear. The higher heat content provides more energy to fuel storm development, while weaker winds allow the storms to develop without disruption.

Now is the time to be proactive and ensure you are ready before a storm threatens. These tips can increase your readiness in the event of a hurricane:

NOAA has predicted a 60% chance of an above-normal Atlantic Hurricane season, due to a confluence of factors including warmer than average ocean temperatures and forecasted weak wind shear. The higher heat content provides more energy to fuel storm development, while weaker winds allow the storms to develop without disruption.

"As we witnessed last year with significant inland flooding from hurricanes Helene and Debby, the impacts of hurricanes can reach far beyond coastal communities,"

Acting NOAA Administrator Laura Grimm

Acting NOAA Administrator Laura Grimm

Now is the time to be proactive and ensure you are ready before a storm threatens. These tips can increase your readiness in the event of a hurricane:

- Download Shield24 for easy access to your insurance information.

- Need information about logging in or creating an account? Get help here.

- Build a disaster supplies kit.

- Prepare a supply of non-perishable food, bottled water, medicine, flashlights, and, if needed, pet supplies.

- Make sure to fill your gas tank and refill your prescriptions.

- Sample list: Ready.gov Recommended Supplies List

- Establish a family communication plan and document a place to meet in the event of an emergency.

- Plan how you will leave and where you will go.

- Designate someone as the emergency contact in case of separation from others.

- Make advance evacuation plans.

- Dial 511 from any phone for travel information in Virginia, North Carolina, and South Carolina.

- Virginia DOT evacuation maps

- North Carolina DOT evacuation maps

- South Carolina EMD evacuation maps

- Print important items.

- Print copies of emergency phone numbers, insurance cards, and IDs, and place them in a secure, waterproof container.

- Keep your cellphone charged.

- If a hurricane is in the forecast, have your phone ready and purchase backup charging devices to power electronics.

- Detail your possessions.

- Create a list of your belongings, including photos and videos where possible.

- Review your homeowners policy with your insurance expert to ensure you have adequate coverage for key items.

- Contact your insurance provider immediately to begin the claims process. Ask what to expect and note any filing deadlines or required documentation. Your carrier's claim contact information can be found here or in your Shield24 app.

- Discuss temporary relocation coverage. Maintain a record of expenses incurred (i.e., hotel bills and pet boarding) and keep receipts.

- Talk with your insurer before making permanent home repairs to ensure they don't affect your claim.

- Avoid discarding items until an insurance representative has assessed them for damage, unless they are hazardous.